As an international business and financial center, Hong Kong is also a special administrative region under the "one country, two systems" policy. It has a different company system and tax system from the mainland.Hong Kong's Companies Ordinance and Inland Revenue Ordinance both stipulate that Hong Kong companies must submit audit reports and complete tax returns as required.

Bank accounts are frozen or even closed, and money cannot be freely used

Bank accounts are frozen or even closed, and money cannot be freely used

High taxes and fines were imposed

High taxes and fines were imposed

Directors and shareholders will generate relevant legal risks

Directors and shareholders will generate relevant legal risks

Unable to participate in bidding, financing, etc

Unable to participate in bidding, financing, etc

Prerequisite for listing

Prerequisite for listing

Necessary documents for cancellation of the company

Necessary documents for cancellation of the company

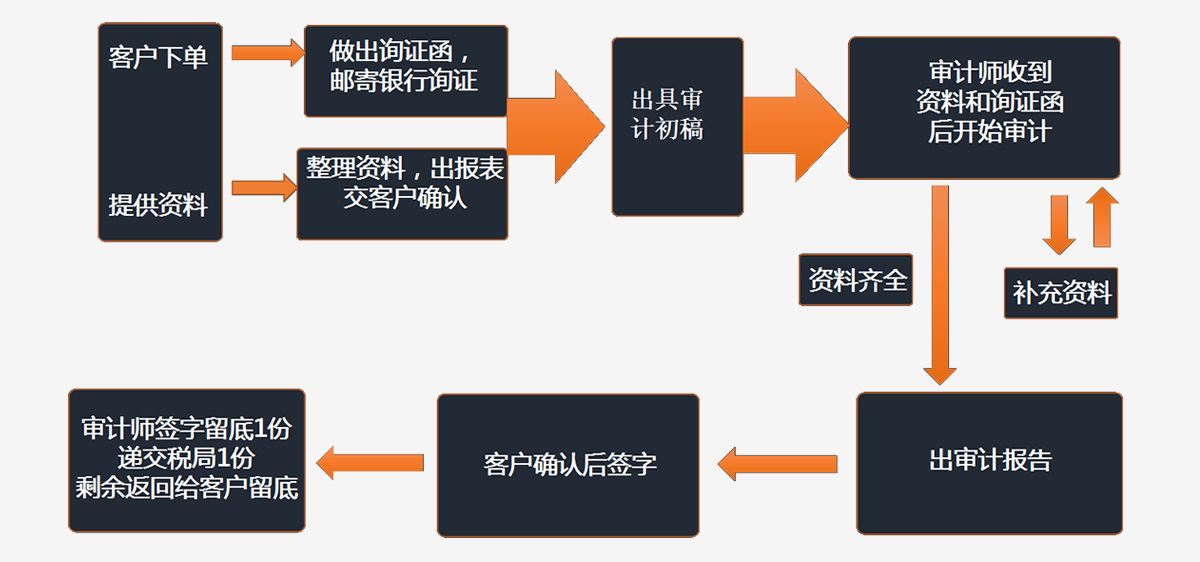

Service system Our team consists of certified public accountants, tax accountants, lawyers and other professionals. Specialized teams will be set up for different customers to provide customized services. In the early stage, financial data will be matched with original vouchers provided by customers, and the draft audit will be prepared after confirmation.

Service system Our team consists of certified public accountants, tax accountants, lawyers and other professionals. Specialized teams will be set up for different customers to provide customized services. In the early stage, financial data will be matched with original vouchers provided by customers, and the draft audit will be prepared after confirmation.

Financial data are more accurateWe will first sort out and check the information provided by the customer, reach an agreement with the customer on key points of audit, and sort out adequate and appropriate audit evidence. Issue financial statements after sorting out original documents and give reasonable suggestions based on customer accounts.

Financial data are more accurateWe will first sort out and check the information provided by the customer, reach an agreement with the customer on key points of audit, and sort out adequate and appropriate audit evidence. Issue financial statements after sorting out original documents and give reasonable suggestions based on customer accounts.

Communicate more efficientlyEstablish a project team, keep close contact with customers, ensure that customers' questions can be answered at any time, and communicate with auditors immediately after the audit draft is issued, so as to accelerate the audit work.

Communicate more efficientlyEstablish a project team, keep close contact with customers, ensure that customers' questions can be answered at any time, and communicate with auditors immediately after the audit draft is issued, so as to accelerate the audit work.

Archives are more tightly managedBecause the tax bureau will make tax inquiries in the same year3-4Therefore, whether the data is kept completely and properly is related to the success or failure of the tax defense. We will save the audit data of clients7years , have enough information to respond to tax inquiries by the tax bureau.

Archives are more tightly managedBecause the tax bureau will make tax inquiries in the same year3-4Therefore, whether the data is kept completely and properly is related to the success or failure of the tax defense. We will save the audit data of clients7years , have enough information to respond to tax inquiries by the tax bureau.

The follow-up guarantee is more perfectWe will assist our clients to fill in tax forms, employee returns and other relevant materials, assist our clients to deal with inquiries from the Hong Kong Inland Revenue Department, patiently interpret audit reports, and provide free consultation on audit issues.

The follow-up guarantee is more perfectWe will assist our clients to fill in tax forms, employee returns and other relevant materials, assist our clients to deal with inquiries from the Hong Kong Inland Revenue Department, patiently interpret audit reports, and provide free consultation on audit issues.